Possibilities offer more freedom and you will potential efficiency, but also far more chance. It depends on your needs, risk endurance, as well as how long you’lso are ready to purchase learning. Jessica Inskip try Director from Individual Lookup at the StockBrokers.com, taking 15 years of experience inside broker and you will trading means. A former FINRA-subscribed agent, she held Collection 7, 63, 66, and you will cuatro licenses.

Dictate the choice period of time

Assume people needs a particular stock to experience large rates action following the a funds announcement on the Jan. 15. You can even change almost every other ties, that it will be useful to look at an informed the-as much as agents. Pick is to obtain an options broker that works to you. If pricing is the only question, then you may see applications such Webull otherwise Robinhood fascinating. If you would like an even more full-searched sense, then you have multiple other choices. Here is the value of the choice, whether or not your’re the customer or the merchant.

How we benefit

Possibilities offer possibilities whenever put correctly and will getting unsafe when made use of improperly. For individuals who’lso are traders-ais.com a new comer to the choices industry, take your time to know the fresh intricacies and exercise prior to placing down really serious currency. American choices is going to be exercised whenever prior to expiration, however, Western european options is going to be resolved only at the fresh said expiration day. The outside influences are commonly described as the newest wings of the newest butterfly, and also the to the hit while the body. Closely linked to the fresh butterfly is the condor—the difference is that the center choices are maybe not in the same struck rates. A name choice provides the owner the authority to buy an inventory, and you may an excellent put alternative supplies the owner the right to promote a stock.

Why do people buy or sell alternatives?

What if their advanced try $10 for each and every share, as well as the possibilities deal is actually for the high quality one hundred shares. This means you will have to shell out a complete premium from $step one,100 on the option. That way, should your cost of the newest inventory — and you may, therefore, all of your stock investment — really does miss, potential earnings on the set will help offset some or perhaps all of the losses on the stock investment. Ultimately, you might still lose a tiny, nonetheless it acquired’t getting up to you might have lost with just the newest inventory funding.

In such cases, the newest investor expectations that solution expires worthless as they hold onto the advanced they made in exchange for creating the option. To shop for a lengthy label setting you happen to be betting to the hidden asset price ascending. Particular traders buy enough time phone calls but offer her or him prior to termination, perhaps even before crossing the newest hit price, should your advanced has grown, thereby permitting these to turn a profit. Other people hold on so long as you’ll be able to to see if it could easily obtain nice gain the brand new investment zooming after dark struck speed by the point the new termination go out hits.

The newest buyer produces an excellent straddle by buying one another a great $5 place option and you can a great $5 phone call alternative in the a $a hundred struck rate and this ends on the Jan. 31. In case your express speed increases a lot more than $46 before termination, the fresh short phone call alternative might possibly be worked out (or “named aside”), meaning the fresh trader will have to supply the stock at the option’s strike rates. In this case, the newest investor can make a profit out of $dos.twenty five for each share ($46 struck speed – $43.75 cost base). The possibility loss on the a lengthy lay is bound to your advanced purchased your options. The maximum make the most of the career are capped while the root rates are unable to lose less than zero, but as with an extended label solution, the brand new put choice leverages the newest trader’s return.

Very first tips for newbies are to purchase phone calls, to purchase leaves, promoting secure phone calls, and buying defensive places. A protected call method involves to shop for one hundred offers of your hidden investment and you will selling a call option up against those individuals shares. When the trader sells the phone call, the fresh option’s premium is actually accumulated, thus decreasing the costs foundation on the shares and you can getting specific drawback protection. Inturn, because of the offering the possibility, the brand new investor agrees to offer offers of your root at the option’s strike price, and thus capping the new trader’s upside potential.

If your inventory rates falls so you can $38 during the expiration, the phone call alternative tend to expire worthless, however the set option usually obtain well worth. The fresh lay was really worth $step 1,000 (100 offers × $10), and you will once subtracting the first $285 costs for the lay, the new trader are certain to get an internet obtain of $715 for the place solution. If $three hundred loss on the expired phone call choice is subtracted, the brand new individual’s overall make the most of the new strangle method will be $415 ($715 – $300). A put alternative author threats losing if the market price falls below the strike rate. The seller is actually forced to pick offers in the strike rate during the expiration. The fresh writer’s losings will likely be high based on how much the brand new shares depreciate.

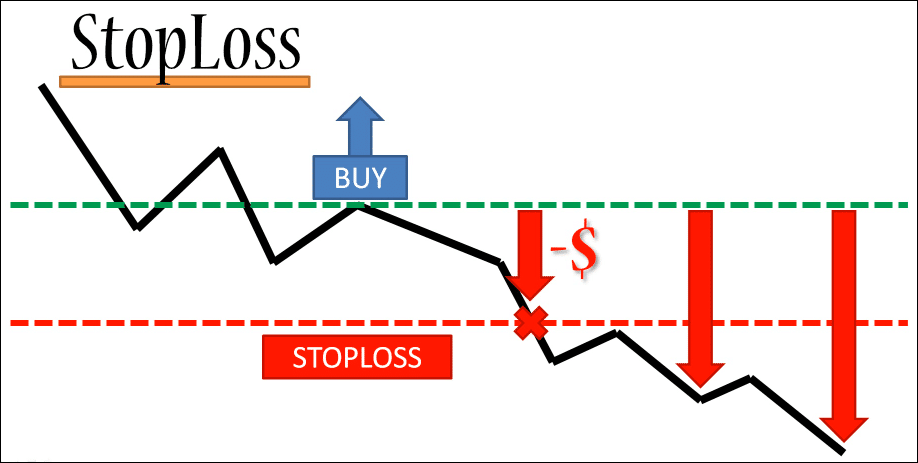

- People can use this plan such as plans; it kits a price floor if the stock’s price drops dramatically.

- You will want to check with your courtroom, income tax, or financial advisors prior to one economic decisions.

- To possess efficiency information latest to the latest month stop, delight contact us.

- If the stock’s rate stays $a hundred, their call options are in the-the-currency, and you will find the inventory at a discount.

Here is the speed where the option consumer can also be get it done the ability to pick (in the example of name options) otherwise promote (regarding lay possibilities). The possibility of using choices because the influence to increase output is one to having fun with control of any sort magnifies portfolio volatility. In addition to, a stock price transferring the alternative guidance of an attack rates can also be lower the worth of a choice to $0. Playing with possibilities, you might obtain increased exposure to a stock without needing a fortune. Rather than purchasing the shares myself, you should buy a visit option for a much lower speed. As the inventory grows within the value, the worth of the call alternative as well as develops, and you have the option of offering one option ahead of the expiration day.

Most agents designate some other quantities of possibilities change recognition based on the brand new riskiness and you will complexity in it. The brand new four actions talked about here do the fall under the most earliest account, height step one and you can top 2. Consumers away from brokerages usually normally have getting recognized to have choices trading up to a specific level and keep maintaining a good margin account.

Directory options are centered on an underlying market list, such as the S&P five-hundred or perhaps the NASDAQ a hundred. Unlike commodity, index choices are compensated within the dollars, while the underlying investment cannot be myself introduced. Risk tolerance is an additional important factor to take into consideration as the change possibilities cover high exposure over stock trading, including the potential to get rid of over your principal. Trading options means an evaluation of many important aspects and you will an excellent clear master away from choices exchange basics is vital for achievement in the which complex business. Basic, you will need to has a powerful comprehension of choices fundamentals. He’s complex economic devices which need a higher level of degree compared to holds or securities.

The fresh termination day is the latest time the newest offer will be traded otherwise resolved. Individual Later years AccountsSelf-directed personal senior years membership are supplied by Public Paying, a subscribed agent-specialist and you may person in FINRA & SIPC. Information regarding senior years accounts to the Societal is actually for educational objectives simply that is perhaps not taxation otherwise funding information. Visit the Irs website for additional info on the new limitations and you can income tax advantages of Traditional and Roth IRAs. Treasury Profile.Funding advisory characteristics for Treasury Membership are provided by the Social Advisers LLC (“Public Advisers”), an enthusiastic SEC-joined funding agent.

Best reports, finest moving companies, and trading facts delivered to their inbox the weekday before and you will after the market shuts. Program accessibility and you can reaction times is generally subject to market requirements. Accessibility OptionsPlay’s separate program for within the-breadth options degree, trade facts, and statistics. Add OptionsPlay Tips provided by OptionsPlay into your Fidelity trading system, letting you consider and you may trading wiser.